)

While separately sales and marketing teams each have their own KPIs to track, there are a few broader business metrics that everyone needs to stay on top of. Managing these financial KPIs is essential to keep the company running smoothly and to help it grow.

After all, financial KPIs are essentially at the heart of every business. And a business’s finances grow primarily because of their sales and marketing teams.

Keep reading to find out why your sales and marketing departments ought to become more financially literate, as well as which financial KPIs both teams should be tracking every month.

Why financial literacy matters

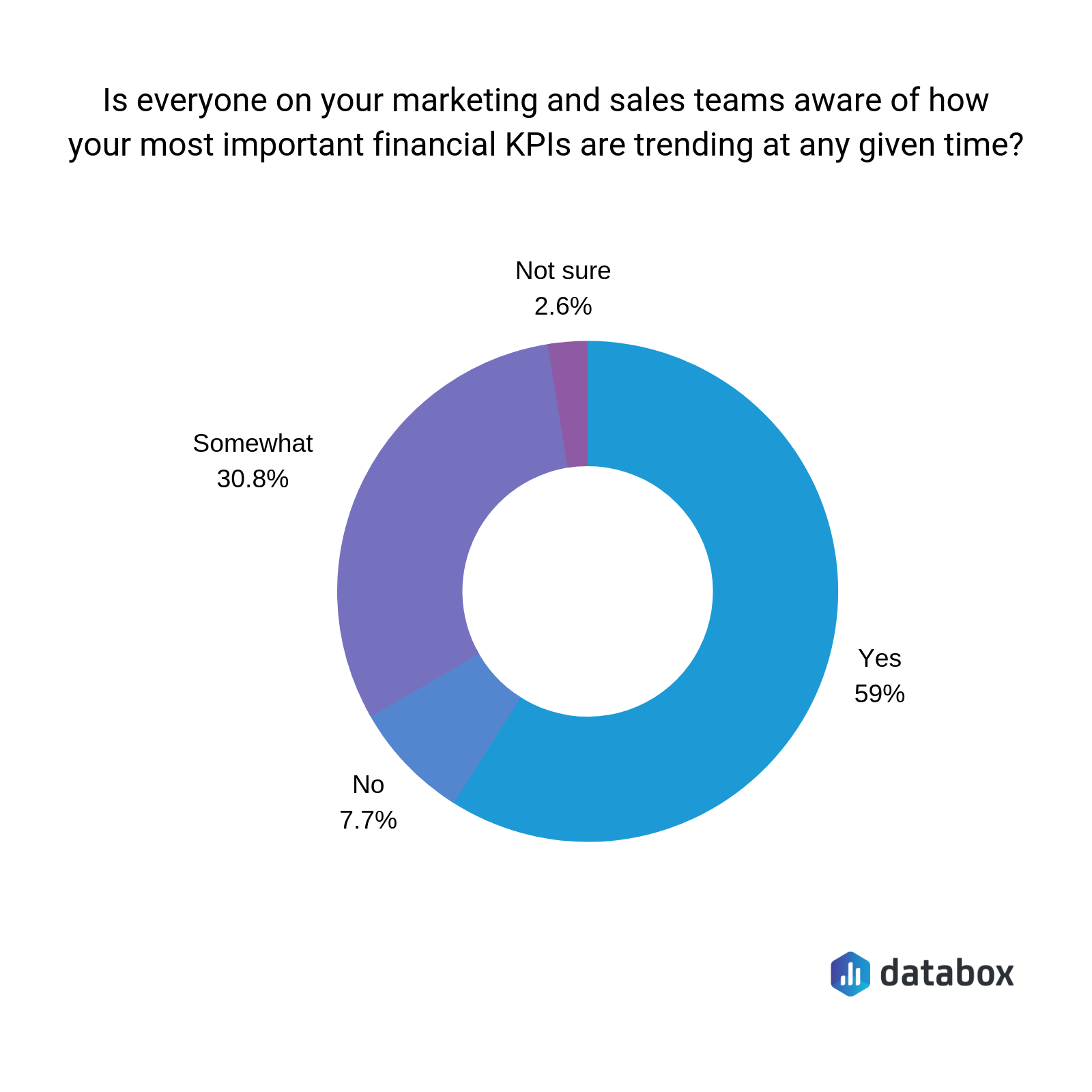

A survey by Databox showed that only 59% of companies said that everyone on their respective marketing and sales teams were aware of how their financial KPIs were trending at any given moment:

Source: Databox

Financial literacy should be a skill that is promoted within all factions in a company, including marketing and sales.

For one thing, being able to read numbers and know what they connote can fine-tune a team member’s intuition.

Marketers and salespeople alike can become better at forecasting reasonable trends based on hard data: numbers from the previous months or quarters.

Additionally, by being more financially literate and knowing exactly where their company lies money-wise, marketers and sales personnel can get a sense of ownership over the company.

These teams can feel even more closely that their performance plays a part in the company’s overall financial health, allowing them to shift their mindset about their job and contribute more to the company’s growth.

There are several kinds of financial KPIs your sales and marketing teams can start tracking, but in the next section, we take a look at 8 of the most essential ones.

8 financial KPIs to track for marketing and sales teams

Revenue/sales by channel

You’ll want your sales and marketing teams to know which channels are bringing in the most revenue. Doing so lets you focus on the high-performing ones and adjust those that aren’t performing well.

This also benefits businesses who have seasonal products and campaigns. By knowing your ROI per channel at any given time, you can identify which channels may just be eating up your ad spend during off-peak months instead of bringing in more customers.

Just as important to note: knowing which channels are most profitable is only the tip of the iceberg.

Sales and marketing teams should work together to glean insights about why this channel outperforms the rest and whether or not it’s the most cost-effective channel for the company.

Profit margins

When salespeople put in all the hours of work to get a client only to earn a fraction of their commission, it may be because they aren’t aware of how frequent discounts and low pricing are hurting their profit margins.

By educating them and showing that it’s possible to earn more by selling less, especially if they forego the use of discount tactics, both profit for the salesperson and the company increase in the long run in a more efficient way.

To make sure your sales personnel don’t use low prices as their only way to close a sale, teach them better sales strategies as well as actionable ways to make sales more productively.

Conversion Rate

Sales and marketing teams need to stay on top of their campaign’s conversion rates. After all, they need to know which of their items in a funnel are converting well to get visitors or leads to take a desired action.

Knowing which channels and campaigns convert best can help them create similar campaigns on the same or related channels.

This is also where A/B testing can play an important role and provide insights. Let your marketing and sales teams figure out which variables to test, and create different variations on a campaign based on those variables.

Because A/B tests always measure some kind of conversion – be it clicks, sign-ups, purchases – you can come up with better insights after tracking conversion rates from a successful A/B test.

Customer lifetime value (CLV)

Surveys and studies have shown that the probability of closing a sale to an existing customer is 60%-70%. But closing a sale with a brand new customer? Only about 5%-20%.

Because it’s always more cost-effective to keep marketing to current customers than it is new customers, tracking customer lifetime value (CLV) is crucial.

Coming up with campaigns that keep current customers loyal becomes easier when you know your CLV. But more importantly, a company then knows if it's spending too much to acquire new leads.

Measuring CLV might be a little tricky as well. Sometimes a customer may only purchase once, indicating low CLV at face value. But this same customer might be constantly referring friends and family to the company’s products or services, so this factor must also be taken into consideration.

Together, your sales and marketing teams can determine who your best leads are, including those who might not have spent the most on your products but who might be generating more leads and referrals for you.

Cost per lead

Once your sales and marketing teams know how much they’re spending to acquire a lead, it becomes easier to identify which channels are most cost-effective across all campaigns.

This also allows for more opportunities to test and grow. Using what they know from looking at your cost per lead, your team can then use and test different effective lead generation strategies.

Channels or campaigns that do well deserve more or the same amount of the budget, while channels that aren’t converting as much can take a backseat and be replaced by a fresh strategy.

For example, you might find that email marketing has the best conversions across all your channels. Then you can start to use higher-converting email marketing strategies that can get you more leads and interested customers.

Lead-to-client conversion rate

If your business has the tools and resources, it’s easy to track your revenue versus your spending to turn leads into clients. Email marketing software, landing page builders, webinar software platforms and the like often have built-in tools to help you see at a glance what your conversion rates are.

If you’re a small business, you can use the formula below to compute for your conversion rates manually:

Lead Conversion Rate = Total No. of New Customers / Number of Leads * 100

Note that lead conversion rate in this case refers to leads who become customers.

Once your sales and marketing teams track this number, you can identify which are your highest revenue-generating campaigns, compare your ad spend, and compute for your ROI.

Customer acquisition ratio

Your customer acquisition ratio is basically the ratio of your customer lifetime value and customer acquisition cost (CAC).

This metric can give a good estimate about how much value you get from a certain customer versus how much it costs to acquire that customer.

Generally, if the ratio is high, that means your sales and marketing teams are doing well to get good customers for the company.

While a high customer acquisition ratio is generally a good thing, it can justify increasing marketing spend to acquire more customers. While this will lower the ratio by the numbers, continuing to acquire new customers is what helps keep your company growth constant.

Return on investment (ROI)

Return on investment (ROI) is the main KPI that sales and marketing teams should already be tracking. Without this information, it’s impossible to determine which channels are outperforming others and which campaigns are only eating up ad spend.

Let’s illustrate this through an example.

Here we have Quick Loans Direct, a company that helps small businesses acquire loans without all the lengthy approval times normally associated with them. Say, they put 5% of their marketing budget on Facebook ads while only 2% goes to search engine marketing.

Their paid ads on Google might be outperforming their Facebook ads five times as much, getting them interested leads to convert and apply for a loan immediately.

They might still continue to churn out budget for Facebook with a low ROI while not knowing that search engine marketing might deserve more budget because of its higher return.

Using what they know about their ROI, Quick Loans Direct is able to figure out just which initiatives, projects, and campaigns to keep putting money in, knowing that it gets them the best quality leads and future customers.

Develop a dashboard to track company finances

Starting to track different KPIs is an essential step. It might also be a big step to start doing, but one of the ways you can ease the process is creating a dashboard that tracks your revenue versus your acquisition channels.

Databox, for example, developed a template with HubSpot and QuickBooks that can you help your marketing and sales teams track the overall health of the company based on their marketing expenses and revenue in a given period.

A few other good options to explore include Chartmogul - especially for SaaS revenue projections - and Geckoboard.

You can also create your own templates to fit your business needs, then share this with your sales and marketing teams for them to consistently update and track.

This way, your company can stay on top of all your sales and marketing efforts while making sure future campaigns and initiatives contribute to the growth of your business based on historical data.

)

)

)

)

)

)

)