)

Understanding the rules around expense claims can be complex and time-consuming.

Paying for expenses, filling out forms, holding on to the right receipts: it’s no wonder expense claims are one of the most hated parts of working life.

Unfortunately, the expense claim process isn’t just a pain for employees.

Employers must also consider the proofs of payment they need to retain, including how and where to store these, and how to make them available when filing taxes.

In this post, we’ll examine the key steps for collecting accurate and valid proofs of payment. We'll also look at the key rules in the UK and US, so you can be sure you're staying above board.

With our help, you can make it quick and easy to process expense claims and repay your staff, all while complying with your tax requirements.

Let’s start by covering a few basics.

Disclaimer: These are just guidelines. We highly recommend you consult your accountant or lawyer if you aren’t sure how you might be legally affected.

What is a valid proof of purchase?

Most people understand the fundamental concept of employee expense claims.

An employee takes care of a professional expense within the scope of their professional activities, and the employer reimburses them. Simple, right?

But how should a company process a reimbursement, exactly? And what proofs of payment do companies need to retain for tax purposes?

It isn’t always so easy to navigate the ins and outs of expense reports. With all these complexities, it’s no wonder there are so many hidden costs when it comes to expense claims.

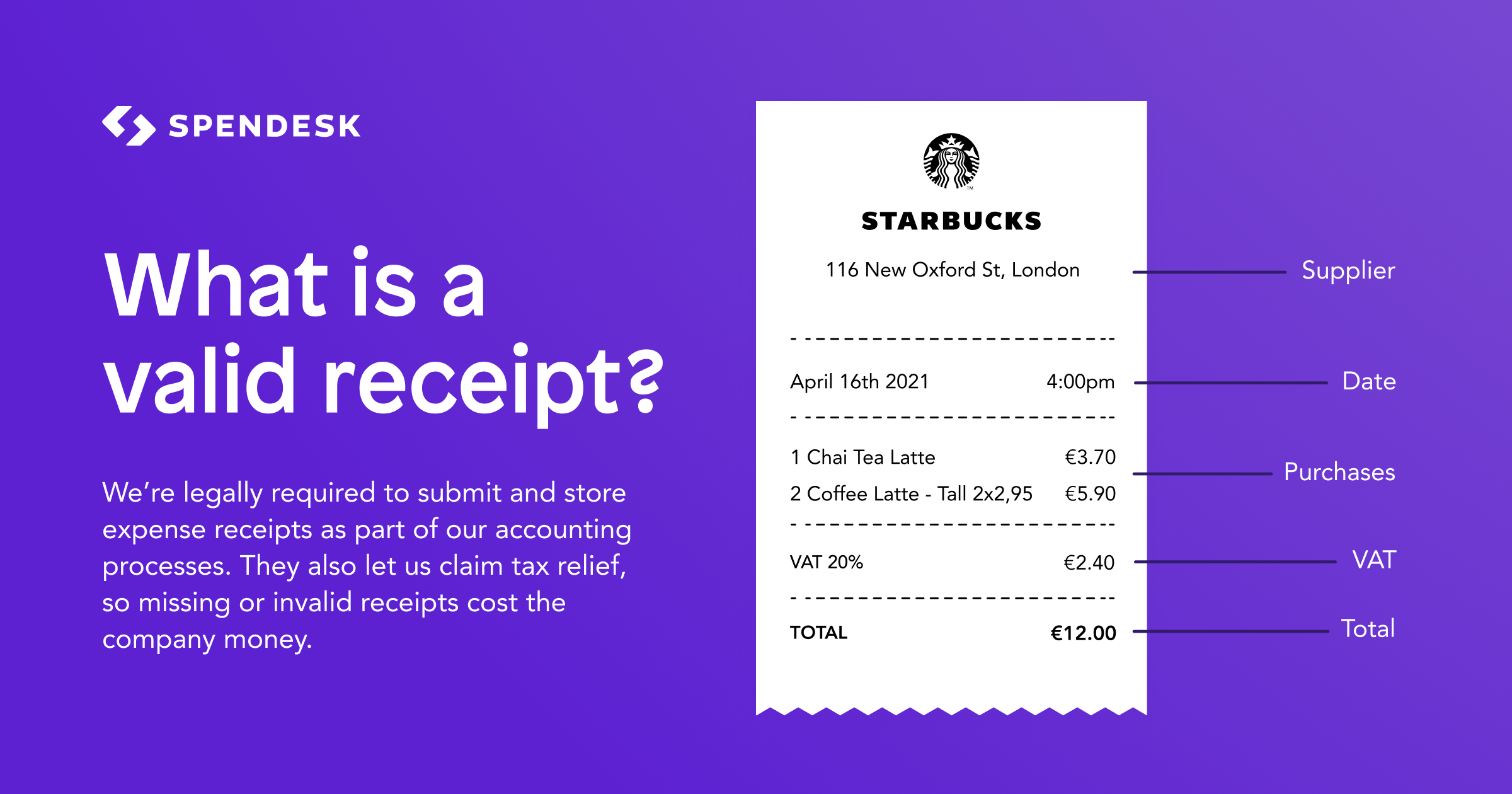

In general terms, a document will be sufficient if it shows the amount of an expense, as well as the date, place and nature of the expense.

For example, a standard receipt will be valid as a proof of purchase, providing it clearly shows these details and lists the amount as being paid:

If you’re looking for more information on expense policies generally, check out our handy guide. It’s free!

Why expense receipts matter

You know that you need a valid proof of purchase. But why exactly?

Companies can claim tax deductions on expenses, but only if they have a valid proof of purchase and can prove it was a business expense. Naturally, most companies love to reduce their tax bill, and this is a completely legitimate and commonplace practice.

A company could, of course, reimburse employees for any payment they make. But if the company wants to be able to claim a tax deduction for that payment, they need proof of purchase.

Most businesses therefore require a receipt in order to reimburse employees as a matter of general policy.

UK expense receipts: Proofs of purchase for HMRC

Basically, businesses in the U.K. are required to keep documents showing the amount of expense claims reimbursed for employees, and to make these available to support tax filings.

However, there are also some specific record-keeping requirements for employee reimbursement.

These requirements differ for individual types of expense, from employee meal allowances to accommodation costs and mileage.

Companies failing to comply with proof of payment requirements can risk prosecution by HMRC. This makes it important to pay close attention to documentation requirements, and to ensure you and your staff comply with these requirements.

Let’s take a closer look at proofs of payment for each type of employee expenditure.

Proofs of payment for different types of expenditure

There are different proof of payment requirements for each type of employee expenditure, though mostly they focus on retaining clear and comprehensive documentation.

Here, we’ll cover the basics with some of the more common expenses:

Meal expenses

Mileage costs

Transport costs

Accommodation expenses

Miscellaneous expenses

To get a sense of the documentation required, take a quick look at the forms relating to taxation for end of year employer expenses & benefits.

Not only will this give you a good idea of the level of detail required: it’ll also scare you and your team into collecting and maintaining the right proofs of payment to support your year-end filing.

Meal expenses

Employees are often confused when it comes to paid meal allowances.

For example, it’s common to read the following plea on expense management forums: “My employer has asked me for proof of my meal expense. Does this have to be a restaurant receipt? Can it be a receipt from a bakery? What about from a supermarket?!”

The answer is yes, it can! An original paper receipt, whether from a restaurant, bakery, or supermarket, is sufficient to satisfy the proof of payment requirements when it concerns a meal expense for just one employee.

However, the situation is different when a meal is paid for as part of wider company entertainment, for example, a meal to which clients or customers are invited.

In this case, proof of payment requirements will depend on the nature and type of the entertainment, as well as who arranges and pays for it.

As a helpful benchmark, it’s best to keep not only the receipts for the meal, but also record the name of all guests and their companies, as well as their titles, and the purpose of the meal or event. This helps provide a thorough account of the expense for tax purposes.

Now, let’s turn to another common head-scratcher when it comes to expense claims and proofs of payment: mileage costs.

Mileage costs

When it comes to reimbursing employees for mileage, there are a few key details that need to be documented. It’s important to get these right.

First of all, the employee must provide the registration of their car, as well as the make and model and list price. For cars registered after 1 January 1998, an approved Carbon Dioxide emissions figure must also be provided.

The reason for the trip must be noted alongside the total mileage for the trip and the dates of travel. Employers should keep secure copies of all relevant information to support tax filings.

Employers must also process mileage reimbursements consistent with government rates and guidance. This is subject to change with each fiscal year, so be sure to check it out regularly.

In addition to mileage costs, there are also specific documentation requirements for wider employee transport expenses covered by employers. Let’s take a closer look at these.

Transport costs

For employee transport costs, it is crucial to retain documentation on the exact reason for the trip, together with a copy of any relevant tickets.

This includes season tickets either provided to employees or reimbursed, loans made to employees to buy season tickets, or contributions to subsidised or free public bus transport.

An employer can also reimburse the journey for the employee to get from their home to the place of departure (station, airport, etc.), providing documentation is collected to explain these costs.

However, this doesn’t cover reimbursement for the daily commute from home to the employee’s usual place of work.

Another common expense employers need to consider? Accommodation expenses.

Accommodation expenses

As with transport expenses, reimbursing your employees for accommodation expenses is covered by specific rules.

For end of year tax filings, employers must provide the cash equivalent or relevant amount of accommodation provided for an employee or their family.

The proof of accommodation requires a detailed invoice, which should mention:

The number of nights’ accommodation

All costs charged to the relevant room, house or apartment

A zero balance for any outstanding charges

However, there are some important exemptions to paying employee accommodation expenses, for example, where the employee is a family member (even a family member who also works for the company). Employers should be familiar with these exemptions.

Miscellaneous expenses

Whatever the nature of the expense incurred by the employee, employers must always remember that all reported expenses must be justified by comprehensive documentation.

A good general rule for miscellaneous expenses is to keep enough documentation to tell the full story of the expense and why it was paid, and to keep receipts wherever possible.

Serious consequences for non-compliance

In the UK, the tax authorities require justification for all reimbursed costs.

Companies attempting to claim reimbursements without the proper supporting documentation can wind up facing serious consequences, including prosecution.

Wherever possible, it’s best for companies to collect and retain receipts rather than just invoices. Receipts contain a larger number of information, including the date of the transaction, the nature of the goods purchased, and the method of payment.

In contrast, an invoice includes only the name of the supplier and the nature of the goods provided. Although an invoice is helpful documentation, it doesn’t constitute proof of payment.

If all this talk of non-compliance has you rattled, don’t worry: there’s a handy way to automate these processes and help you collect the right proofs of purchase every time.

Receipts for the IRS: The case in the United States

The general principles still apply in the U.S. If you want to be safe during an audit, you'll need a proof of purchase for every expense deducted.

But there are a few key exceptions, as helpfully described by Bench.co:

Generally speaking, you can get away with not keeping a document for three reasons:

The expense is less than $75. (Note: this doesn’t apply to lodging expenses.)

The expense is for transportation, and it’s not easy to get a proper receipt.

You’re reporting lodging or meal expenses under an accountable plan with a per diem allowance.

And even with these exceptions, the IRS can still question expenses under that $75 threshold during an audit. You'll have to show them that the payment was essential to the business, and provide supporting evidence like the people present (in the case of a meal, for instance).

So your best bet is to have a robust way to file receipts, and never get caught out.

Automate your proofs of payment with Spendesk

The rules governing the justification and reimbursement of expense claims are not always easy to follow. Given these complexities, it isn’t hard for employers or employees to make errors.

With integrated expense management solutions like Spendesk, you no longer need to deal with unnecessary paperwork or inadequate proofs of payment.

With Spendesk, you and your team can automate your expense report processes, as well as dematerialising your receipts and storing them in an online platform.

Spendesk not only simplifies the expense claim process; it also automatically captures and stores receipt information, storing everything securely for easy recovery.

Say goodbye to those teetering stacks of receipts, and switch to Spendesk. That way, you and your team won’t have to spend so much time worrying about collecting proofs of purchase.

In the meantime, if you have more detailed questions regarding proof of payment or tax treatment for particular types of expenses, be sure to talk to your finance team or accountant.

And for a more detailed guide to expense management, we have you covered:

)

)

)

)

)

)

)