)

Few things feel better for founders and company leaders than watching your team grow. It's usually clear validation that your business has a bright future. And building a great company was probably the reason you started in the first place.

What’s not quite as exciting are the logistics behind managing your employees. Thankfully, HR and payroll software can handle this, so you can stay focused on the vital work in front of you.

Consider the fact that the United States is home to more than 11,000 jurisdictions for sales taxes, in just one country. No wonder so many businesses get hit with payroll penalties.

In light of these payroll processing challenges, we’ve rounded up the five best payroll services for your review. Compare the options and choose the most suitable platform for your business needs.

What is payroll automation?

Payroll automation is the automation of the payments you make to your employees. Online payroll software solutions make automated payments to your employees’ accounts, and keep track of those payments come year-end tax season.

With payroll automation software, you can rest easy knowing that you’re withholding the correct amount for the tax payments you owe. Payroll automation even helps you manage holiday hours and overtime calculations.

Certain banks that offer free business checking accounts, like Wells Fargo, offer their own payroll solutions, tax programs, and insurance. As a small business, it’s good to complement services like these with a spend management platform created for rapidly growing businesses like yours.

Now that we’ve defined payroll automation, let’s dive into our top five picks for the best software for growing businesses.

Payroll automation software examples

1. PayFit

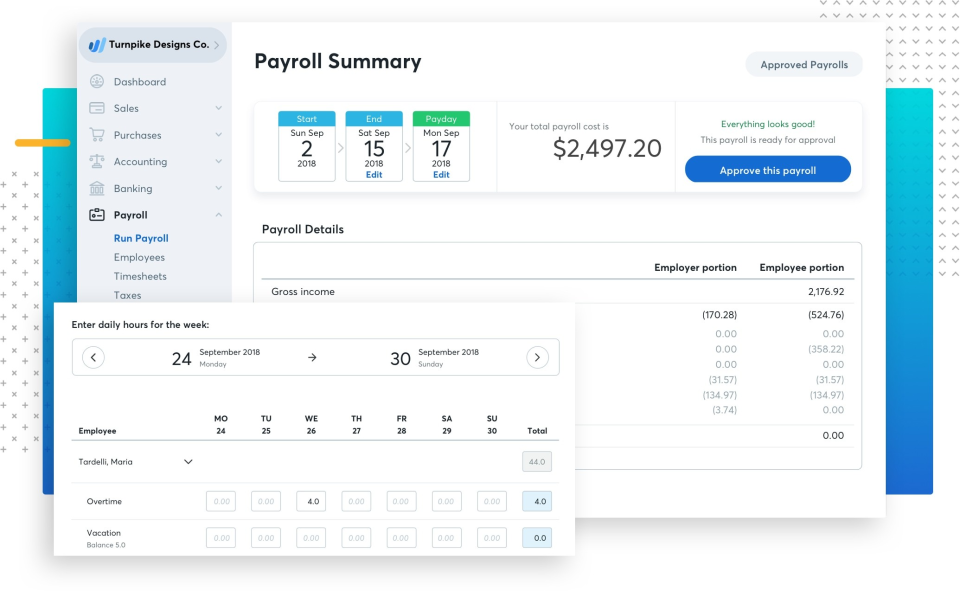

At the top of our list is the cloud-based solution PayFit. One of the best parts about PayFit is that it squares you away with the regulations and rules before you ever actually automate your payroll. After you’re set up, PayFit lets you make changes and calculate payroll, overtime, and taxes in real time, and with only a couple of clicks.

PayFit assigns businesses a dedicated payroll expert who’s familiar with your region’s rules and regulations. These experts set you up correctly during your onboarding phase and create a calendar that accounts for local holidays.

PayFit pricing depend on the country (or countries) in which you process payroll, and the number of employees involved. Request a demo to get specific pricing details.

2. Personio

Advertised as an all-in-one HR software tool, Personio lets small business owners automatically transfer their employees’ salary information to its preliminary payroll solution - no detailed lists or number-crunching required on your end. Personio’s preliminary payroll also lets employees update their personal information at any time and automatically highlights employee updates for your review before you approve them.

One of Personio’s biggest draws is its time-saving series of interlinked processes. With Personio, business owners can automatically transfer time-tracking and performance management information to ensure employee wages and bonuses are always accurate.

And since Personio stores all of your data in a single location, your employees can access their pay stubs from a personal file.

3. Wave Payroll

Cloud-based software solution Wave Payroll lets small business owners process payroll and payroll taxes in all 50 U.S. states. Wave Payroll lets you manage payroll, deductions, and taxes through a single easy-to-use platform for both salaried employees and contractors.

If you connect your employees’ and contractors’ accounts with Wave Account, Wave will even file taxes for them depending on the state in which they live.

In addition to its tax payments and filings capabilities, as well as its direct deposit payments, Wave also automates entries made in your accounting journal to reduce time spent on bookkeeping. Your employees can use Wave to access W2 forms and pay stubs securely, and it lets them update their banking and contact info at any time.

Wave offers businesses a free 30-day trial to help them get started, after which pricing plans vary depending on the state in which your business operates.

4. Square Payroll

Square Payroll automatically calculates how much you need to pay regarding state and federal payroll taxes, and it takes care of your quarterly filing, too. Small business owners can enjoy an unlimited number of automated payroll runs, and they can accurately collect employee information thanks to Square’s integration with time-in and time-out software.

A key benefit of using Square Payroll is its range of health benefits. Square partners with SimplyInsured to offer health insurance plans with some of the best life insurance companies and partnerships with healthcare providers. It also collaborates with AP Intego to help you manage workers’ compensation insurance amounts without requiring you to pay any fees.

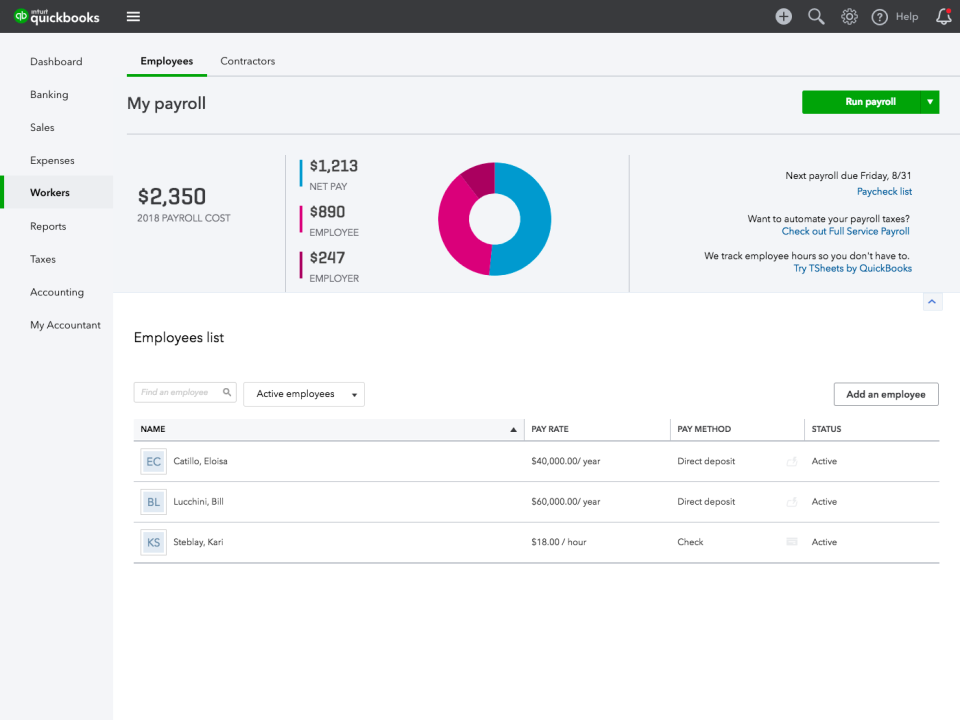

5. Intuit QuickBooks Payroll

Last but not least is Intuit QuickBooks Payroll, an online payroll software solution that, as you may have guessed, fully integrates with Intuit’s other software solutions. In fact, arguably the biggest plus that comes with using Intuit QuickBooks Payroll is its flexibility and integrations: users can integrate books and HR solutions and can even upload their tax filing to Intuit’s TurboTax.

Plus, Spendesk synchronizes with your QuickBooks account, meaning you can capture more than 95% of your receipts on time and close your books each month with a single click.

Pricing for Intuit QuickBooks Payroll is relatively transparent, which you can find on their Pricing page here.

Conclusion

Deciding on the right payroll software for your business isn’t a decision to be taken lightly. Fortunately, multiple online payroll software solutions offer robust features, integrations, and user interfaces to suit business owners without much payroll processing experience.

)

)

)

)

)

)

)